- Center for Strategic Management

- Center for Innovation

- Center for Start-up-Management

- Center for Digital Business Transformation

- Center for Governance & Compensation

- Center for Sustainability Management

- Center for Executive Coaching

- Center for Leadership

- Center for Change Management

- Center for Personal Leadership & Motivation

- Center for New Work

- Center for Communication

- Center for Rhetoric

- Center for Neuro Intelligent Leadership

- Center for Marketing Management

- Center for Brand Management

- Center for Online Marketing & Social Media

- Center for Resilient Marketing

- Center for Sales Communication

- Center for Financial Management

- Center for Mergers & Acquisitions

- Center for Controlling

- Center for International Management

- Center for Asia

Center for Financial Management

The St. Gallen Center for Financial Management has the explicit goal to apply the basics of financial management for the customer's benefit comprehensively and application-oriented. The consulting and training work focuses on concrete analysis and decision-making tools. The ultimate goal is a long-term and sustainable increase of corporate value through the implementation of customer-specific solutions. After the joint elaboration of a forward-looking and outward-oriented financial corporate governance, our experts assist in its implementation through hierarchy appropriate management training and integrating employees into the elaborate concept.

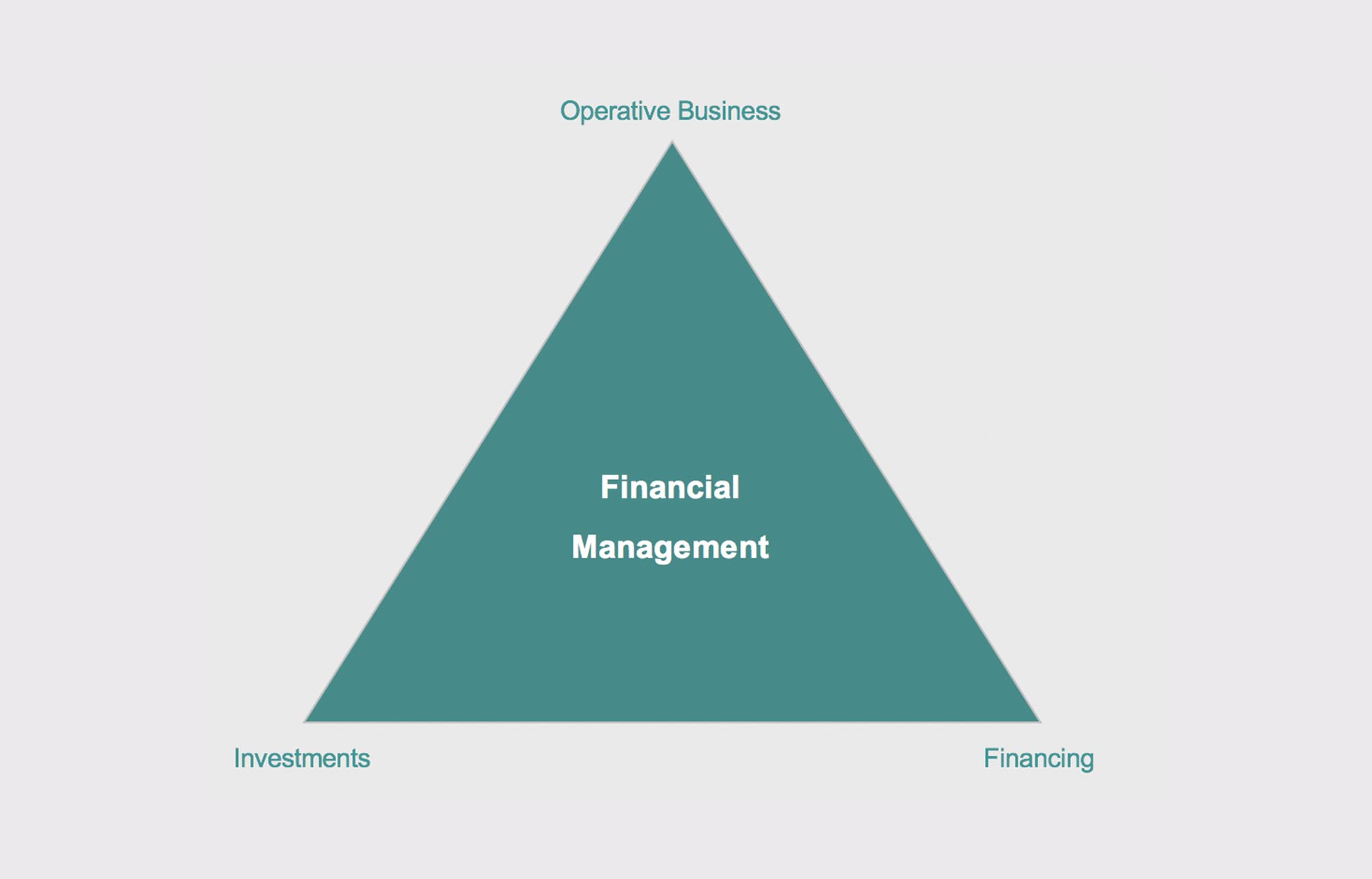

In the view of the St. Gallen Centre for Financial Management, financial management includes much more than the company's focus on profits. Sales and cost management undoubtedly are an essential dimension of financial management. However, the income statement alone cannot always explain the success of a company. A company such as Amazon, for example, was not making any notable profits for years, but still generated enough cash from operations to finance an average growth of more than 20% while showing immense values in market capitalization. To explain such situations, the components of financial success have to be reviewed more comprehensively.

Traditionally, in the German culture, a company's profit resulting from business operations over one period is paramount in financial management. In recent years, this one-dimensional view has been supplemented by working capital, i.e. management of accounts receivables, inventories and accounts payable. In the German-speaking area too, Cash Flow, a more comprehensive measure of success compared to profit, is increasingly used to analyse business operations.

However, many industries had to realise that today's healthy operating cash flow does not guarantee future entrepreneurial survival. Nokia is just one example where the good results of the past came to an abrupt end in the near future. We are at the beginning of the fourth industrial revolution and investments into the future need to address the ever-accelerating technological change. For us, financial success therefore always includes a time long-term component, which must be anchored in the company's incentive and reporting systems.

In our view, financing represents the final essential dimension of financial management. It has to support achieving the company's strategic goals and allow affordable access to the necessary liquidity.

These statements clearly show that we see a close connection between the company's strategic and financial management. The financial management is responsible for contributing to the implementation of the strategy. In this process, the company's organization needs to be taken into account. Organization theory states that the structure of the company follows the corporate strategy. The financial management follows the strategy and the structure. A profit center organization requires a different financial management than a functional organization. Financial responsibilities need to be defined with a view to the success of the entire company in order to enable the implementation of the corporate strategy. In a rapidly changing world, internal distributional conflicts must be avoided and the company's outward orientation strengthened. This is our key strength, thanks to our extensive project experience in various industries.

Consultant services

- Joint development and implementation of value-based controlling concepts

- Joint conception of financial control principles for large international corporations (e.g. target figures of various cost and profit centers or bases of internal transfer prices).

- Joint definition and implementation of internal incentive systems aiming to achieve a long-term sustainable external orientation of the company.

SGMI Open Programs: Seminars

Masters and Diplomas

Publications

Head

Thorsten Truijens, Dr. oec. HSG, MBA

Director of the Center for Financial Management at SGMI Management Institute St. Gallen

After studying in Germany, the US and in Switzerland, Thorsten Truijens started his career in the controlling department of a multinational automotive company before working for a consulting firm. As director of the Center for Financial Management at SGMI Management Institute St. Gallen the focus is on international corporations that value and count on profound knowledge of the continental European and the Anglo-American view on financial management and highly appreciate the practical approach. Furthermore, Thorsten Truijens has repeatedly presented lectures at various prominent international universities such as Harvard Business School on the topic of financial management. He also won numerous Best Teacher Awards.

His main topics include:

- Value-based Financial Management

- Performance Measurement Systems

- Internal Management Systems

- Balanced Scorecard